Precious Metals Investment Notes 1

Presents excerpts from various precious metals related articles, followed by personal commentary.

Financial - May 18, 2013

2013.5.17. The MoneyChanger (pdf)

"Dow/Gold today reached a new high at 11.25 oz. (G$232.55 gold dollars), up 2.4% Dow in Silver vaulted 14.6 oz. (2.2%) to a new high at 687.35 oz. Those higher prices sent me scurrying back to the charts trying to make sense of it. Looking back at the Dow in Gold's fall from it's last peak in 2007 at 21.06 oz., today's price doesn't quite reach a 38.2% correction. Today's close left the Dow/Gold barely above its long term (14 year) downtrend line. Right, I'm chewing my nails, too, wondering when reality will kick in." [Franklin Sanders' commentary was based on New York COMEX May 17, 2013 close prices of $22.33 for silver and $1,364 for gold.]

Comments: I've been invested in precious metals since 2008. Silver went from $20/oz. to $8/oz. in 2008, and now, five years later, it sits at about $22. Silver has been super volatile, with my adding to my position at $29, $31, $35, $39, $41, and (cough) $45 per oz. It will be a while before I see a profit from the silver purchased at the higher levels. At least I was able to buy a little more at the recent lows in the $22 range. No one in the precious metals community thought that the Federal Reserve could keep the whole fiat ponzi system afloat for as long as it has. "The fraud works," they say, "until it doesn't." Everything is rigged through the purchase of paper futures contracts. Even the Dow Jones Industial Average itself can be manipulated higher through futures contracts that are basically just bets that the index will go higher. So the idea, basically, is to "add to your position" on a regular basis, especially on "pull backs" in the price. It is universally agreed that the leviathon-sized debt is unpayable and will have to be inflated away or written off, but as to when that will happen only the insiders know. The strategy presently is not to cause the herd (us) to stampede; hence, the various central banks in the world actively seeking inflation targets of 2% or 3%, which amounts to 5%-10% annually when honestly measured. If they can persist in this money printing regimen with no obvious shocks to their control of the system, then 20 years of this (with no increases in people's incomes) will destroy the wealth of most people on the planet. There will likely be something real or tangible backing the new currency, at least for the settling of international trade. (The serfs in each nation will probably be tossed back onto another fiat system after losing 90% of their purchasing power when the current one implodes.) When this global reset occurs, it will be helpful to know when to SELL your tangible assets. In 1934 and again in 1980, gold hit relative highs of taking just 2 oz. or so to "buy the Dow." Given present valuations, that would be a 500% move up in price, with stocks (equities) remaining flat (gold being $1320 and the Dow 15,300). With gold at $7650, I'd be looking for a silver-to-gold ratio of 20:1 or so, or $382/oz. But maybe I'd sell my silver when it's 25:1. This would be the optimal point to purchase a home, or to shift back into stocks. I don't know how long it will take for this to happen. My fall back position is to continue to work as a school teacher for the next 25 years if necessary, although I would welcome the opportunity to retire before then. The experts say that a precious metals investment is not for speculation or a quick profit, but rather a hedge against inflation and loss of confidence in the banking and financial system. It's a long term hold, to be passed onto your dependents when you are gone. However, having said that, when/if the masses (include the large institutions) flee their domestic fiat currencies in search of protection against massive devaluations -- and if they flock to precious metals -- there will at some point not only be a much higher permanent price for PMs, there will also be a large bubble where the PMs are valued much higher than they should be. This, too, will be the time to sell.

2013.5.19. It’s Official: Gold Is Now The Most Hated Asset Class (pdf)

Harlequin001:

I've said this before and I'll say it again. Ask yourself this, if we live in a world where any central bank can print enough new money to buy all the worlds' gold, why isn't it constantly being shipped from one country to another at ever increasing prices? Why are China and Russia constrained to adding to their reserves FROM MINIMG SUPPLIES, and why will it take 7 years to repatriate one 10th of Germany's gold to the Bundesbank?

The answer is that gold is still, and has been for 50 years now the only 'commodity' that isn't for sale FOR ANY AMOUNT OF PAPER MONEY in the central banking system.

Why is that?

The answer is IMO because TPTB after WWII required collateral to make loans to rebuild a devastated Germany and Europe post war when there was no effective collateral other than gold, and that was in the US and UK. They needed to create new collateral to fund the rebuild, fast, and that collateral was debt. It was a requirement. They've done this before, they know how this ends, they knew how this would end back then. It ends in both inflation and default, and when it does the only countries with gold will still be the post WWII powers, i.e. England and the US. Every other country including Asia knows that when the default finally comes the asset side of their now somewhat T Bill bloated balance sheets will implode, counterparty risk will be 100% and they will have no gold for their currency.

Try as they might there is no way the Fed or the BoE will allow any central bank to take gold paid for in post war fiat hence China and Russia scrambling for mining supply and Germany's problem in repatriating its gold. There remains not one central bank not capable of placing a 400 tonne long to counter the April 12th short if they needed gold to be stable for their reserves, yet they didn't and still don't. This is because they don't have any real gold despite what is supposedly stored by the Fed and BoE. The Central Bank Agreements on Gold were a paper exercise, which means that Asian and European economies continued existence is still dependent on the USD, and they know it. This ends in default. That's when the Fed and BoE take back their gold from JPM and HSBC et al and every body else gets to eat the $700 Trillion credit loss that no one can see coming. We already know how this ends. China and Russia have until then to accumulate as much phys as they can before it's too late, because central banks aren't selling it at any price in paper. If they don't mine it they have no choice but to keep the party going.

If you want to go invest in the stock market go knock yourself out, I'm sure when push comes to shove you will find plenty of very tall fiat paid for buildings to jump off, and remember freefalls's cool till it's not, as many stock markets are about to find out...

TwoShortPlanks:

The average person, the so called astute investor, and MSM can hate it all they like. They are a fickle bunch and will back-flip when the breeze changes direction.

What matters is the change in the season, not today's wind direction. What's the real money doing?

Bullion Banks: The game ahead

Not since Rothschild scooped in and bought all the War Bonds of England and War Debt of France at Pence on the Pound, just hours after the Napoleon’s defeat, have I heard of such a set-up as today’s Gold Space.

The Bullion Bank’s [Hasty] Ambush is set, the Gold Market is merely awaiting the ‘Official Runner’ to bring the real news of the War on Gold. They will skim the physical till the runner arrives. The runner's news will lift the veil cloaking the reality of Gold in the market, and trigger mass panic in many sectors of the financial markets.

Rothschild may well have been very impressed with this financial manoeuvre.

http://twoshortplanksunplugged.blogspot.com.au/

“Physical Gold:

The argument that modern wealth is so large that it is immobile and therefore will not move en masse to physical gold.

To this point I first pose a question. Where has all the physical gold gone? Central banks have gold on their books but a major percentage, maybe a shocking percentage, is leased out with counter party risk. Simply stated, if the lease is not renewed the central banks must drop the gold from their assets therefore the leases are renewed constantly knowing full well the gold is gone. The theft of gold is the second largest crime in world history, second in size to the fraudulent legacy of OTC derivatives that caused the entire mess.

The paper gold market is in its death throws right now due to the downside manipulation and the knuckle draggers do not even appreciate that. With the automatic and forthcoming elimination of paper gold as the price setting mechanism, physical gold will seek much higher prices than anyone can conceive of.

I mentioned that a price of $50,000 an ounce was possible when physical gold is emancipated from paper gold. To that a popular previous gold writer turned Trojan Horse simply dismissed it as Jim being extreme rather than argue the subject.”

Harlequin001:

But where has the gold 'gone'?

Seems to me that it's still sitting in the same place it always was but now with a 'billion' paper claims to it, none of which will be honored when the derivatives collapse finally arrives.

It will all go back to where it should be will it not, back to the Fed and BoE, and goodbye JPM and HSBC et al?

And then we can start again, with the West lending 'collateral' to the rest of a world in which everyone else including Joe sixpack realises that the bond market blow up just cost them their pension, stock portfolio and house valuation. Real poverty will be upon us all and the bankers will ride to the rescue once again, but this time with an all new set of banks, all collateralised with real gold priced at much, much higher prices...

And at that point every gold bullion investor will discover that if you haven't got a very good tax plan you're fucked, but at least they saw it coming...

Harlequin001:

But that's my point, Germany amassed what 3,800 tonnes of gold, on paper anyway and Gordon Brown sold 200 tonnes of UK gold but where did it go? When did the Germans or anyone else ever take delivery?

They didn't, that is other than Venezuela, and Chavez is dead now for whatever reason. Venezuela is already running out of basic necessities despite being oil rich. I believe they were allowed to take delivery only because Chavez was belligerent and couldn't be bought off, and because it was a relatively small amount of gold needed to keep the great sham going. It too was a requirement.

So where is the rest of the gold? It's still within the grasp of the Fed and BoE. This is the great scam. Foreign central banks know they can buy it but can't ever take delivery of it and the Fed and BoE know they can sell it without ever losing control or ownership of it. When it all fails their claims will be settled first and everyone else will be stunned that they have only paper and no gold. It's why all central banks are still playing the game and no one complains at the volatility in the price of the only real asset they can 'own' but can't have. They have no gold. Only the Fed and BoE have any.

So where are the multi tonne longs on the Comex waiting for delivery to Asian central banks?

Even HSBC just bought silver from KGHM in Poland for delivery 'over years'. Why bother when you can buy it from the market if it's cheap? It seems that everybody is desperate to accumulate physical from anywhere BUT the market it seems because they are shit scared of pushing the price up when they do.

SilverDoctors:

Steve- we suspect that the only investors hating gold as an asset class are those holding paper claims, particularly those with futures contrats at the HKMEx, who has just announced the exchange will cease trading and will cash settle all contracts Monday 5/20!

http://silverdoctors.com/hkmex-to-cease-trading-will-close-out-cash-settle-open-contracts-monday/

nidaar:

"Never believe anything until it has been officially denied." Otto von Bismarck

Even if I had no interest in gold & silver, I would start buying after reading this stuff.

2013.7.7. King World News Marc Faber Interview * partial transcription here and here

Faber has recommended in the past that an investment portfolio be allocated 25% equities (stocks), 25% real estate, 25% gold, and 25% cash. Also, if you have the means, it would be wise to diversify within each category by geographic location (e.g., outside the US for real estate and precious metals holdings, or non-US currency and stocks). Faber has spoken about placing gold in safe deposit boxes in the duty-free zones of international airports, such as in Singapore. This insulates you from bank thefts (if the safe deposit were housed in a bank), and if the US, say, were to outlaw gold ownership, or tax it excessively, then being able to hold, sell, and buy gold anonymously in foreign jurisdictions like Singapore or Hong Kong could be very helpful. I made my decision in 2008 that over time precious metals would outperform stocks and other assets. One of the targets shared was a gold-to-DOW ratio of 2:1 as marking the top of a bull run, at which point you sell your gold and buy equities. (Presently, the DOW is about 15,000; so gold would have to be $7500 per ounce, or about six times what it is now, with stocks remaining flat.) This may yet be true. For example, if the G-20 governments collectively decide to create a gold-backed currency they will need to set a price for gold that sufficiently backs their outstanding debt. Calculations using different ratios of debt-to-gold put gold's price at $10,000 to five times that amount(gold is curently at $1250). This is all well and good, but what if all your resources are tied up in gold, and gold has crashed, with the global "reset" of the gold price still seven years off -- and you have a big medical bill to pay? Timing is everything here. Some people can't wait and must sell their assets at an inopportune time. I've likely got another 20 years of full-time employment ahead of me before I can retire, so I am banking that my income will be sufficient to meet my needs, and that 20 years will be sufficient time to see gold at a much higher valuation. But for my mother it is not that way, and I feel badly about pushing her into the metals just before this recent sell-off. She's down 30% and hasn't even been invested for more than a few months. From the perspective of a narrow investment horizon, cash earning less than 1% looks much better to her. She's now full of regret. It eats at her and I am blamed for it. It's because of situations like this that distributing your assets among the categories as Faber has laid out is a good idea; because if you have to raise cash at any given time, you can choose the asset that has performed the best. Investors who follow the herd "buy high" and "sell low." You don't want to be forced into a situation that causes you to do this.

Faber stated that the governments (via government agents like JP Morgan Chase) who control the futures prices in the commodity markets (to support the US dollar) may crush the prices of commodities even further, even if it means that all the producers/miners can't make a profit. And when gold is at $600-$800, for example, then governments could outlaw private ownership of gold and force everyone to sell their gold to them at 1/3rd what it was just a year or two earlier when many of them bought it. This would be just before the governments unveil their new gold-backed currency. There are many precedents for this. US president Franklin Delano Roosevelt did this in 1933: after confiscating gold at $20 per ounce, he promptly reset the value at $35. This is theft of the wealth or purchasing power of the people. According to fascist/communist/statist mindset citizens exist to serve the needs of the state, and not the other way around. Franklin Sanders stated recently that during the 1930s four world leaders confiscated gold from their people: Mussolini, Hitler, Stalin, and FDR.

I've listened to perma-bulls like Eric King, James Turk, and Franklin Sanders who are always saying that precious metals are undervalued and that the next leg up in the bull market for metals is just around the corner. They continue steadfastly in their optimism, even as gold is down 37% from its high in September 2011, and silver down an excruciating 62% from its high in April 2011. Pretty much everyone is in agreement that the markets -- whether stock prices, interest rates, or the prices of commodities from wheat to hogs -- are rigged. Catherine Austin Fitts estimates that $40 trillion has been sucked out of the US economy in the last 15 years to fund a shadow government or "break away civilazation" as she and others call it. The shadow banking system is valued at 100's of trillions of dollars, i.e., much larger than our publicly acknowledged assets. Eric King, Max Keiser, and the people at ZeroHedge all believe that the fraud and manipulation are now so huge that a collapse is inevitable and not far off. Or as Eric Sprott said, so many things (deceits) are being juggled in the air by the bankers that something has to break -- or that a "black swan" event has to occur -- i.e., a market upset that no one saw coming. So a lot of precious metals holders are hoping that the sysem breaks down, which will cause a massive panic out of paper financial instruments like stocks and derivatives, and into "tangibles" -- real things without counterparty risk. An ounce of gold in your hand is not a promise that someone else will pay you something at a later date: It is a thing whose value is inherent and no one can defraud you of it unless they pry it physical from your hands.

Sadly, just yesterday I listened to a recent Solari Report (subscription only) where Catherine Austin Fitts said there is a 20% chance that the bull market in the metals is over -- that the metals won't make new highs anytime soon. By implication, her fear is that the shadow financial system is so huge and the manipulation so systemic, that gold's function to reflect (and hopefully curtail, by virtue of it's rising price in fiat currency acting as a warning sign) runaway money printing by governments will be suppressed indefinitely. That is, governments can run massive deficits each year, with their fraudulent Federal Reserve "Notes" growing ever more numerous, with no commensurate rise in the valuation of gold (or other commodity). Fitts said that inflation is being held in check by people's wages going down, even in nominal terms, as trillions more dollars are being created. Food and energy prices are going up generally;or if it is not going up, then the quality is going down (by using inferior ingredients, or smaller product sizes for the same price). The largest gold producers like Barrick are said to be controlled by elite families like the Rothschilds who are intent on the continued engineering of this whole catastrophe to further their aim of breaking nation states and asserting a new global governance controlled by the financial oligarchs.

At this point I feel a bit like a financial Luddite, or a financial "extremist." I have no faith in the US Federal Reserve Note or the New York Stock Exchange. I want no part in the financial market. So I will stick with land and precious metals. What I lose in purchasing power I will makeup for in righteous indignation. :(

2013.8.2. King World News Interview with Chris Powell

Powell discusses a 1300 ton or 25% decrease in gold holdings of the Bank Of England that coincided with the latest price drop in which several hundred tons were sold (dumped) into the market during illiquid times (such as when US and British commodities markets are closed, but smaller markets open) in order to drive the price down. Powell calls this a "gold price suppression scheme" and a "dollar support scheme." He draws comparisons to the currency market rigging via manipulating exchange rates that the Nazis engaged during the 1930s and 1940s. Powell believes that the physical gold required to maintain the ongoing suppression of price is running out, and thereby also the ability of the elites to continue this game.

My comment: Having listened to Catherine Austin Fitts the last few years (I joined shortly after getting destroyed by the silver collapse in May 2011; I wanted some source of information that might be able to help me anticipate these market swings -- manipulated or not), I do not underestimate the capacity of the elites (the usurers, the reptoids, the Rothschilds -- whatever you want to call them) to keep the ponzi system afloat. As Fitts argues, the debt that countries are drowning in is not primarily a financial matter but rather one of political control. The debt will likely stay there (no jubilee, no writing down of debt), and gold's price will remain in the toilet, because these are conditions that are necessary to continue US dollar hegemony -- and the means by which the financial interests who controll that currency can buy up the world's assets. This all leads to the abused term, "New World Order" which is actually the old world order where the middle class is wiped out and the financial oligarchy asserts control of the -- in name only -- "nation" states which are all just subordinates of a single global fascist sytem of governance. The financial interests are running the show and this is their game.

If the elites start to lose control -- vis a vis the gold price going up too fast, which calls into question the value of fiat currencies (which have no inherent value and are merely instruments of debt) worldwide -- then governments will change all the rules. They will do whatever it takes to maintain control: tax gold sales at 90%; ban private ownership; regulate ownership to the point that no one is able to buy it anymore; criminalize transactions that use gold as payment; ban gold from being shipped by mail (as France recently did); ban brokerage accounts that have more than 20% of their assets in precious metals (as the US has now done -- Fitts has discussed this regulatory push to define precious metals as "imprudent" investments) and so forth and so on with any commodity or behavior that is a threat to the power structure.

So what are my thoughts given that most of my assets are in precious metals? I am with Jim Rickards, Jim Grant, Kyle Bass, and many other "smartest guys in the room" in believing that gold will eventually at least partially back a new international monetary system; and, in which case, will have a very high price set not by the market (which would be high enough if allowed) but by whatever percentage of debt needs to be backed by something tangible in order to have faith and trust reenter the financial system. There are many formulas out there, but given that outsanding debts that need to be settled exceed 1000 trillion US dollars (mostly all fraudulent Credit Default Swaps and other fake paper that traders make 2% on when they create and sell them -- almost all created since 1999 when Glass-Steagall was overturned that had previously barred these practices), and given that gold exists in a fixed, limited amount, the price could be 10x or more the current price. This entails that there will be a bust at some point. All the charts and calculations demonstrate conclusively that nation-state indebtedness cannot be fixed as their debts are now dragging heavily on economic growth -- i.e., we cannot "grow" our way out of debt anymore. The debts will have to be inflated away. You will wake up one morning to find that you are now in possession of a "New" US, Canadian, or Australian dollar -- but the only problem is that you have to use 10 of your old dollars to buy one of the new ones. You could lose 90% of your purchasing power overnight. So if you believe in this scenario, then what is happening now in August 2013 is just a waiting game. As former Federal Reserve Chairman Alan Greenspan said, "Markets can remain irrational longer than you can remain solvent." I can wait 20 years before needing to liquidate my metals holdings; but my mother, who has lost over 50% in some of her silver purchases doesn't have such a long investment horizon. You haven't lost a penny unless you have sold something at a loss. Hopefully she won't have to sell anything, because to date she hasn't. The primary wildcard in all of this is deflation. I have read that deflation is worse for the banks than it is for the citizens of a country (something about asset values plunging and therefore the balance sheets and solvency of banks). Fitts says that much of the inflation we should be seeing is held in check by wage deflation. No one who earns a salary or hourly wage has seen his or her earnings increase go up in the last 5 or more years. Most people are losing good-paying jobs with benefits and are now working parttime with no benefits. I know that I am making less now than I did in 2007. The elites were upset that so many people had the extra money needed to travel to remote St. Moritz, Switzerland in 2011 to protest a yearly Bilderberg meeting. Crushing wages keeps the peasants in check -- ensuring that they have much less free time and excess income to enable their uppitiness. As to how long the Blue Bloods and Reptiles can maintain the ongoing fraud through wage suppression and market manipulation I cannot say. They control the gold mines (like Barrick) and the financial ratings agencies (e.g., Standard and Poor). They can change the rules of the game whenever they want, or start a major war and through the media justify it by any rationale they think will sell the best. But as silver mogul Eric Sprott said recently in an interview, they've got so many things in the air to juggle that something has to break. Will the timing of this "Black Swan" or breakage be of their choosing? Will the collective impact of millions seeking to be independent of their machinations (via chemtrailing, TV mind control, pharmaceutical drugs, public education, God-lessness, et cetera) be enough definitively to tip the scale toward liberty? We shall see!

2013.11.13. King World News Interview with Stephen Leeb

Here's my summary of this short audio interview. More countries moving away from the US dollar as a reserve currency. China has agreements with Australia, Russia, and Japan to settle transactions in their own currencies, sidestepping the need to buy US dollars. This trend is growing, and the US will be less able to export its inflation to other countries. Increasing talk of Russia, China, and Germany preparing for some kind of new gold-backed reserve currency that will compete with the US dollar. All of this is inevitable as the US produces little these days except for the fiat currency it exchanges for real goods it purchases from abroad. Gold will go up in value -- in nominal, fiat currency terms -- as this arrangement takes shape over the coming years. Hong Kong just filled another 2000 ton capacity gold storage vault for elite interests. For every 1 ounce of physical gold there are 100 ounces of paper derivates used by government agents like JPMorgan Chase to manipulate the physical price. Gold continues to flow from West to East. No audits of sovereign gold held either in the US or England are allowed. Many believe the gold has been sold or "leased out" and is now in Chinese, Indian, and other countries' possession.

Comments: It's been a tiresome few years. It's seems that every week another hundred or more tons of synthetic gold is sold in the futures market (at a loss) to drive physical prices down. Even corporate pundits agree that there are no longer "markets" where transparent supply and demand create prices, but rather, opaque "interventions" by governments to "manage" prices. How long can commodities be kept at values that are below the cost of production? The answer, it seems, is longer than many investors can remain solvent. Gold and silver need to be kept down in order to support the public perception that only the US dollar is a safe place to park wealth -- that only the US dollar can be trusted to keep its purchasing power. It's an illusion backed by trillions of US dollars conjured into thin air by the US government and the private banking interests that control it. When the gold price reset occurs, who knows if it will even be legal to own it, or whether it will be taxed at some insane level like 75%. There is no telling what the criminals in charge won't do to maintain power. As Fitts has said, we must see all this debt creation as a political tool to control and subordinate not just political entities such as nation states, but every individual person on the planet. So the rule of law and even the outcomes of financial mathematics will all bend to the will of elite political interests bent upon global dominance.

2013.12.14. Note to family member

I wrote the following to a family member today, who was expecting a sizeable amount of cash to be distributed upon the sale of a home.

Recommendations:

-20% to remain as cash in bank [at local credit union -- which I prefer because they are non-leveraged, engage in less reckless speculation, and are not publically traded as the commercial banks like JPMorgan Chase and Bank Of America are -- in other words, their duties are to their customers and not to distant, profit obsessed stockholders];

-40% American Eagles (under present tax regs, unlimited AE's can be sold without tax reporting - no other gold bullion products have this feature);

-20% Gold Money gold in Singapore or Hong Kong or Switzerland; you can have the gold shipped to you in 100 gram increments, no need for money wires to you; important to have some funds outside US jurisdiction if you want to set up shop elsewhere and there are draconian capital controls in the US; in the next few years they may restrict cash outflows from the US to other countries, so it would be good to set up now; it only costs you $15 to wire the money to GoldMoney and they give you a $15 credit;

-20% Tocqueville Gold Fund (this is a precious metals mining fund, with 10% invested directly in bullion); this may be the only way to hold gold at some point if private gold ownership is made illegal again as it was from 1933-1974; also, the mining stocks are terribly depressed at present and will likely outperform PMs by 5 fold, so if gold doubles (2x), Tocqueville should go up 10x;

2013.12.19. Email exchange with best friend from college

A good friend asked me "Are you buying more gold?" when he sent me the following:

"THE WALL STREET JOURNAL Markets Alert: Gold Falls to Lowest Price in Three Years. Gold slid to the lowest price in three years Thursday after the Federal Reserve said it would cut back on the easy-money policies deployed to steady the U.S. economy. Gold for February delivery, the most actively traded contract, fell $41.40, or 3.4%, to settle at $1,193.60 a troy ounce, the lowest price since August 2010, on the Comex division of the New York Mercantile Exchange. Front-month gold for December delivery fell $41.10 to $1,195.0, also a three-year low."

I responded:

Are you trying to antagonize me? I told everyone a couple of years ago to mortgage their homes to buy silver when it was $33. You told me you didn't expect it to make 10% per year going forward, and you were RIGHT. It's a confidence game. The dollar is the world reserve currency, with the largest military on earth enforcing its use across the globe. A bet on gold is a bet against the dollar in many ways. But nations are starting to set up trade agreements to settle debts between themselves in other currencies such as the Chinese renminbi. As this gains momentum JPMorgan (that apparently acts as an agent for the US government) etc will have greater difficulty suppressing the precious metals market. Currently, the physical metals price is entirely controlled by bets placed in the futures market. It's quite a shady racket, but no one will be prosecuted because anything that supports the dollar is a matter of national security. There are documented outflows from the west in the range of 2000 or more tons of gold per year; and the Bank of England, the Federal Reserve, and Fort Knox haven't allowed real audits since 1970 or something. So the suggestion is that China, India, and Russia are buying all our gold in these final days/years of the US dollar. Certain interests want the US weak. Then there is the concern about heavy taxation of the metals if they experience some kind of reset and are used to back a new currency or IMF SDR (special drawing rights) (which is currently being used -- US mail going abroad is charged in SDR units). Maybe gold is valued at $10K per oz, but private ownership either won't be allowed or it will be taxed at some crazy rate.

In any event, yes, I am making another $5K buy. Not much, but something. I am already "all in" and am riding the ship down, having not sold my holdings when PMs were in $1800/$45 range. Could the metals go down another 10-20%? Sadly, yes. If the DOW corrects 25%, won't everything be sold, including gold, to make margin calls? Some say that the upside potential is much greater than the downside at this point. A lot of smart money is on the sidelines, waiting for much weaker stock and metals prices. The precious metals hit is all due to the tapering news. But when all the financial markets finally see how drastic tapering is for stocks, commodities, and bank assets, they will rush in to provide even more liquidity, at which point currency alternatives like gold and silver will move up, and we'll see greater inflation across the board.

How long can our economy continue with 100 million people on some form of welfare, and more people of working age are on welfare than are working full time in the private sector? How long can the US run such large budget deficits? When does the other shoe drop and international investors turn away from our bonds? There may be powerful interests that won't allow a Treasury auction failure until such time that it serves their interests. The timing of all this is quite a mystery.

Some people advise that it is best to reduce one's debt, become more independent (in terms of food, water, energy, health, and income), and develop alternative strategies to resort to in case plans A and B don't work out.

My friend responded:

No, I am not. It probably is a decent time to buy. Your points about the economy are well taken and remain very troubling. I have 5 people ask me for money every day in the three blocks between the metro and my office. I bought one a sandwich the other day and she was too mentally ill to say thank you. It weighs heavily on me.

2014.1.18. Sprott: "Manipulation Of Gold By Central Banks Cannot Continue In 2014" (pdf)

HamfistedIdiot (me):

The case against the Fed is part political, part economic, and part moral. I went long silver in Nov. 2008 after Congress gave a blank check to shareholders of the Fed; but as it is said, markets can remain irrational longer than participants can remain solvent. It depresses me to hear that silver demand was flat at valuation levels 50% of what some of my family members bought the metal at. How long before silver reaches a new nominal high? 10 years? How long can the ranks of the FSA ["Free Shit Army] swell till 80% of Americans are on the dole? Is any of this sustainable let alone moral? I don't want to benefit from money printing, so I am out of stocks. But betting against the house/the central planners is a dangerous game. I know there are all sorts of Black Swans flitting about. But with the shadow state's tens of trillions of dollars, I find it hard to believe that the controllers don't have a plan for gold's being reset to $10K and the West having none. I don't see the Rothschilds playing this game to lose. They own the large mining companies like Barrick. Will us plebian bitter clingers and stackers do okay? I am not sure, but I think so, and I know it's the right thing to do.

fockewulf190:

Silver was artificially manipulated and crushed by TPTB because it was becoming a huge problem. Demand for physical silver, even now, continues to be very high, but, as you well know, the price is determined in the paper markets. How many times have we seen massive amounts of paper silver equalling to a third, half, or even an entire years supply of the world´s silver production traded in a single day? How about the senseless smashdowns that happen in the dead of night, often with thousands of contracts being traded within seconds at most, and profit means nothing? Not to mention, NO intervention by the CFTC or anyone else, EVER, besides the occasional lip service by the likes of Bart Chilton?

I understand your frustration, but I feel your anger towards Sprott is misdirected. He for one is having to fight the biggest manipulation campaign ever wrought, yet stocks have been POMOéd tirelessly with untold billions in out of thin air created dollars. If anything, you should embrace the fire sale in hard assets, because one day, this bitch of a market is going to blow, and fiat currencies the world over will vaporize.

Tall Tom:

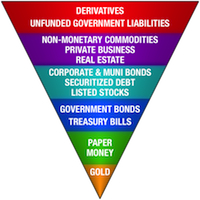

Why so glum, chum? When this blows up life becomes Hell on Earth. Every financial market will unravel as a result of the continual, and multiple, rehypothecation of physical gold because when it comes right down to it gold is at the apex of Exter's Inverted Pyramid.

There will be no trust whatsoever.

What is the claims against deliverable gold on COMEX right now? I read this morning here on ZH that it was at a historic high of 117 to 1. So if it blows up two years from now, rather than right now, it means that you have two more years to prepare for Life in Hell. Think of it as a reprieve from the execution which the Nation of Massive Financial Swindle and Fraud, yes, the United States, so rightfully deserves.

If you have gold then you are not broken...not yet at least. I am enjoying the feel of one on my one ounce Maple Leafs as I write. Just owning one coin means that I own more than my fair share if all of the gold in the world were evenly distributed. You are whining because you are richer than most of the inhabitants on this planet? Shit! Crocodile tears!

More from KCT:

Canadian Maple Leaf 1 ounce gold coin, .9999 pure.

From Wikipedia: Exter is known for creating Exter's Pyramid (also known as Exter's Golden Pyramid and Exter's Inverted Pyramid) for visualizing the organization of asset classes in terms of risk and size. In Exter's scheme, gold forms the small base of most reliable value, and asset classes on progressively higher levels are more risky. The larger size of asset classes at higher levels is representative of the higher total worldwide notional value of those assets. While Exter's original pyramid placed Third World debt at the top, today derivatives hold this dubious honor.

John Exter, 1910-2006, Federal Reserve Board Governor.

ArrestBobRubin:

In my experience, the best approach is to remain open-minded about how best to make "money" (actually just fiat currency) while not losing sight of reality and fundamentals. Unless you're saying that anything has really been fixed (or even substantially addressed) since 08/09, the role of PM as the best form of wealth insurance and diversity is very much alive and well. And as things have actually gotten much, much worse, its role is more important than ever. For what one pays for that insurance right now, it's a screaming bargain.

PM's have been dirtied up in the marketplace by the UST/Fed/Wall Street and a Stalinistic "news media" at the same time they've snookered the dumbed down masses with one paper scam after another. Many so-called investors are "all in" equities right now as if they'd never been burned by the dot bomb, tech wreck, housing slide, or a dozen other scams over the past 25 years. It's hard to fathom this lack of memory- - what, do people really think "it's different this time" with the likes of Obama and Bernanke / Yellen / Fisher at the helm? Yeesh. I can only imagine what's in our food, water and air nowadays.

In reality, nothing has changed. It's just that the Man Behind the Curtain has been working the levers furiously to maintain an illusion of recovery and prosperity. Over the past 2 years, those who can see through it have let the Enemy (the Fed & Wall St.) subsidize the slow but steady growth of their PM stacks. They've made lots of easy fiat in a steroid-fueled stock market bubble and then transformed some of this unbacked "sucker paper" into some of that 4,998 year old real money stuff.

You take what the Defense gives you and let them help you win the game. Welcome to the NFL.

Tinky:

Good summary. My only quibble is that I expect the action to occur sooner rather than later. Too much complexity; too many potential Black Swans; efforts to manipulate are becoming increasingly ineffectual; rats beginning to abandon ship; the dark truth about various economies is becoming increasingly difficult to obfuscate; those who exit first, exit best, etc.

seek:

The biggest mistake I've made in the past 5 years is underestimating the ability of TPTB at pulling rabbits from hats. I think rabbits run out in 2016, but at this point wouldn't be shocked if it ended up being 2018.

I have no doubt things will become broken-er prior to 2016, but I don't think we see the big fireworks until then; maybe late 2015 at the earliest.

Tinky:

I understand completely, and left money on the table myself by getting out of the "market" early. But I see more and more fissures appearing, and remain convinced that TPTB will not be choosing when the gig is up – it will be forced on them, and they won't be prepared.

therover:

Just remember walking away and leaving money on the table means there is less money in your pocket when you walked away. As long as you made out, good for you. Don't look back, only forward.

Seize Mars:

I don't see things the same way as you do.

Regarding the "New World Order" and a single worldwide central bank - I mean I don't really see the big deal - they've already got it. How do you think the US has avoided hyperinflation so far? It's beacause the USD is a mechanism to export inflation. That export gets sent into some pretty big economies; China, India, et cetera.

Now, as far as Russia and China being roadblocks to world domination, you've got to be kidding me. Soviet power was financed by Wall Street. China is using paper money. Come on, it's already in the bag. Syria and Iran are the ones who are not on board, that's why they are in the principal's office.

I think the whole "the whole system will break in 36 months" is a meme, that gets extended on a regular basis. This is intended to keep people in check, waiting for the "the big kaboom" and not doing anything. Only the big kaboom never comes. Time is on their side, at least in the sense that time grinds us down more every day.

They want us poor, dumb, hungry and unarmed. And it's working.

Squid-puppets a-go-go:

re USD exporting inflation: spot on.

when weimar and zimbabwe started printing like no tomorrow, that no tomorrow still took a few years to arrive - But these are isolateable economies.

When you have the entire world as a sponge for the fed's liquidity, hyperinflation can take a lot longer to take hold. $85 billion a month isnt gonna end up in $100 trillion dollar notes for quite some time

But there are other issues that can cause a drop of ice 9 to fall into the ocean: comex cracking, shadow banking trust evaporating, baldry cratering, major player returning to gold standard. When so many of these are on the cusp of occurring, the OLIGARCHY WILL SPLIT, turn on each other, and end the game before it was agreed between them. This temptation to break rank grows each day the agreed deadline draws near - or else other influential parties who have modest clout but arent in the inner-inner circle - and who arent being told clearly the date or conditions for the endgame - will break rank in self preservation

they COULD hold the charade together for years, but some members of the oligarchy will betray the others before then, and its game off, and new game on

Poor Grogman:

A disturbance in the force, I felt it too.

The wait feels like its over, now seems a fine time to convert some useless fiat.

The PTB have a not inconsequential problem with manipulation, in that it costs real gold to carry it out convincingly. Thus the solution is not to do it, but that would mean their pet fiat currencys revert to toilet paper. The PTB continue using/rehypothecating, sovereign (our) gold to trick us into thinking that our gold is worthless, so that we borrow paper from them at interest, pledging our real assets (therefore our labour) as collateral. Hoping for a nominal gain in asset prices that will be overstated ( and taxed accordingly) due to fraudulent and deliberately misleading inflation methodology

Who or what evil genius came up with this unbelievable scheme?

Evil walks among us, largely unnoticed by the poor but honest sheeple of this planet.

Bioscale:

Who? Gary North has several good articles about them, but still I think that even these are just public faces of those evil ones in the backround of whom there is no single word in any history book, be it Rotschilds or other banking cabals.

http://www.garynorth.com/public/department141.cfm (pdf)

2014.1.19. My uncle sent me the following anti-gold article from the Washington Post:

"A gold enthusiast? Listen to the head - and history." By Barry Ritholtz, Published: January 10. "How much money did you make from gold’s spectacular run from under $500 a decade ago to more than $1,900 two years ago? How much did you lose from the 38 percent collapse since its September 2011 peak?" (pdf)

I responded:

I follow the gold story across several websites (Peak Prosperity, Zero Hedge, and King World News, in particular). It's been a rough few years. The US government is spending $1 trillion per year to prop up the stock market and the zombie banks that own the Federal Reserve. We're at historic highs in terms P/E ratios, DOW/median income, corporate profit as a percentage of GDP, etc. Companies are using cheap money from the Fed to buy back shares rather than invest in capital improvements. This boosts earnings. This is the gilded age for sure. JP Morgan has dumped billions of gold sales execution orders in illiquid markets, driving the price down repeatedly. The big boys make money shorting the market, and everyone rushes into the US dollar for "safety." The psychological operation is successful. Precious metals are now viewed as worthless, and the DOW and US dollars are the only games in town. Meanwhile China alone is acquiring 1500 tons annually, nearly the entire annual world production, while the West is selling theirs. I am confident that the US dollar will continue to slide in value, and that eventually there will be a shift away from the USD as the world reserve currency. We already see many bilateral non-USD denominated trade agreements between China and Japan, China and Australia, Russia and Iran, Brazil and China, etc. People are losing trust in the fiscal responsibility of the US government. Many credible voices say that gold will play a part in a future world reserve currency that will emerge after the trust has gone. Many governments that are going broke seize pensions (forcing them into government bonds). Gold is a way of holding wealth without counterparty risk. There have been some high profile cases of investors seeking to get their gold out of GLD (a precious metal ETF) and have been unable to do so. Like MF Global, someday GLD will be viewed as a ponzi scheme. If you don't hold it, you don't own it.

I view the NYT and WaPo as part of the establishment. They're the ones who got us into a war against Iraq based on obvious lies. They do the bidding of powerful interests. Now they are attacking gold. I would take that as a signal to buy. :)

There have been earlier, and steeper retracements of 50% or more, such as in the 1970s, but with gold ending up making greater highs. But "this time is different" in that we are heading toward a new monetary regime. Some say the time to sell gold will be when a new currency is issued after some kind of bank holiday.

Even without hyperinflation, cash will not be safe. The head of the ECB said that "Cyprus is a template," in that failed banks will use deposits as collateral to pay off risky bets. Since then, laws in all G-20 countries have been written to allow for similar "bail-ins" should banks fail again. The average Cypriot depositor got hit with a 40% "hair cut." This will likely happen in the US in the next decade because most of the big banks have tens of $trillions of exposure to interest rate swaps (derivatives) at a ratio that exceeds 50x assets. If interests rates on US treasuries begin to rise, this will threaten the solvency of all the TBTF financial entities whose life blood is cheap money. US depositors have lost $4trillion in income due the artificially low interest rates brought about by the Federal Reserve's quantitative easing (QE) program.

xxxx

2014.7.10. Jim Rickards commentary via Ed Steer's Gold & Silver Daily (pdf)

The following is from Ed Steer, with a quote from Jim Rickards:

I just like to mention that Ted Butler posted his mid-week commentary to his paying subscribers yesterday---and it was a stunner. It's titled "The Silver Conspiracy"---and although I haven't spoken to him since he posted it, I'm sure it's bound to turn up in the public domain at some point.

But in the interim, here's what Jim Rickards had to say about it after he read it last night---

Ed,

Excellent analysis; thanks for sending.

My reaction is similar to Ted's. There is clearly manipulation going on. I focus more on gold than silver, but you need to manipulate both if you want to manipulate gold because if inflationary expectations are raised due to a run up in silver, it will spillover into the gold market, which will undo the Fed's gold manipulation. So you need to squash both.

I also agree that 2008 was a turning point. It's all part of a much bigger play to freeze assets in place, deny access to physical metal, force savings into banks, money market funds, and stock markets and then prevent people from getting out.

This will certainly get worse. Ted's analysis is correct but the problem is even larger than what he is seeing.

All best,

Jim

KCT comments

I encouraged family members to buy gold when it was $1600 or so an ounce a couple of years back. Since then the price in USD has dropped to $1200, although now it is peeking above $1300. Some people are not longterm investors and it pains them to see a paper loss when stocks have gone up 40% during the same period that precious metals have dropped 30-50%. (It's not a real loss unless you sell -- although this may come as cold comfort.) What is a better "value"? A tangible asset like a home, gold, or a bushel of beans? Or Federal Reserve notes backed by nothing but brute political and military force? It's a complicated answer, because as many commentators have noted, due to ongoing market interventions, there is no longer "price discovery" in the financial markets. All assets are either inflated or depressed in value depending on where the Federal Reserve pumps its $trillions of currency each year, or where the political elites set up regulatory blocks and loop holes thereby obstructing or giving preferential treatment various forms of financial commerce. Every financial market and activity is distorted now based on a political agenda. Congress trades stocks based on insider information, and it's considered legal, though even an imbecile can see the danger this presents to a representative democracy. Who is Congress serving? The voting public? Or the people with money/influence/insider knowledge?

Anyway, as I've said a million times, just do the right thing and DO NOT SELL your precious metals at below the nominal valuations you paid for them. As it is said, PMs are not an investment; they're an insurance policy (against hyperinflation or loss of faith in the governance structure). I am thankful that no one in my family in the last six years has been forced to liquidate their precious metals at a loss. How much longer before PMs begin to reflect the inflation caused by out-of-control money printing? Or the $17trillion and growing national debt? Or the $200trillion estimated future liabilities if current entitlement programs are not overhauled? (See ZeroHedge article here, pdf.) Governments across the first world have a choice: Either promote an inflation that decreases the costs of these liabilities, or severely curtail government spending, by reducing its workforce, and reducing entitlement payments and government subsidies of all kinds, including the vast expense of maintaining corporate-government cronyism (with its $trillions of no bid or preferential contracts). People looking at historical parallels have determined that governments always choose inflation because that is the least offensive to the public and governance structure, although it still ends badly, but just buys time before the hard decisions must be made. If a government is spending beyond its means (the US spends about $1trillion more than it takes in each year), reality will eventually bite it, usually through a loss of confidence in its currency.

Who's to say when reality will come back to the western world's financial markets? I for one am tired of holding my breath, and I'm tired of the constant drumbeat of negative PM coverage in the mainstream financial press. The elites want people out of metals and into assets the elites control. That is why I pay the corporate-government media no heed, though I have family members who watch the news shows religiously and harp on their missed opportunities for profit in the insanely over-valued stock market. I am willing to hang on another ten years if necessary, adding more to my stack when I can. Not everyone else can wait.

There is a plan to destroy the modern nation state, especially the USA, which has been an engine for liberty and economic growth for 200+ years. Hence, the headlines today of hundreds of thousands of illegal immigrants being allowed into the USA and provided with food and shelter at taxpayer expense. President Obama just asked for another $3-$4 billion of debt to be issued to house and feed the immigrants at US military facilities. These people are not being deported, but rather are being transported throughout the country by Homeland [in]Security and federal Border Patrol agents. County officials in California report that the massive influx of immigrants is breaking the backs of the counties financially as the illegals seek free education, health care, and welfare support. Some might think that exporting all of our manufacturing and engineering jobs to developing nations was just an economic decision. Or that having a depressed economy with half the working-aged public (over 100 million now) on some form of welfare handout to survive, is just an accident or an outcome of a failed policy. But no, these are signs of policy success. Check further the globalist plan that nears full implementation, the "Cloward and Piven Strategy," where everyone is put on welfare to bankrupt the nation in order to bring about desired political and social changes that would not be possible if any of the past structures were left standing. Here are three articles on the Cloward-Piven Strategy: Wikipedia (pdf), American Thinker (pdf), and Infowars (pdf). You could also say this is the Masonic strategy of Ordo ab chao or "order out of chaos." A weak, bankrupt nation state, combined with the devestation of another World War, could be what the ruling class needs to bring in a banker-controlled one world government, otherwise known as the "New World Order."

But back to the metals. I invest in metals because I don't trust the economic policies of modern governments. You can't "print" gold or create an ounce of silver by pressing a couple of keys on a computer keyboard. But I see now that there will be increasing "financial repression" -- a term I first heard from Jim Rickards, whose quote leads this entry -- which means that governments will create whatever regulations are required to maintain the current power structure: bank deposits will be hit with 50% taxes or "hair cuts;" pensions will be forced into government bonds; assets will not be allowed to leave the USA; property and income taxes will rise to whatever amount needed to fund bloated government operationa; private ownership of precious metals will be allowed, but will be taxed at 90%; et cetera. Who knows what the Masonic sociopaths will attempt to enforce? I cashed out of a government sanctioned tax sheltered annuity (TSA) back in 2008. I didn't want my money in stocks. Modern day accounting practices are a fraud. And I don't like companies owing allegiance to shareholders as opposed to employees and customers. I don't want to "own" a company that I don't have day to day control over and interaction with. Also, TSAs, 401k's, and IRAs are creatures of the government; and the rules for withdrawal or what they are invested in can change at any time. In a staged national crisis, such as a major war, it could be my patriotic duty to cede over half of my TSA account to the government. I don't respect a government that exports all its good jobs and invites the homeless from all over the world to come live here for free. I don't respect a government that actively seeks to increase its welfare rolls. Why should I help pay for that? It's not something I support or voted for. Plus, gold and silver are the only forms of money authorized under the US Constitution. Federal Reserve Notes, which are just debt instruments, are not.

But doing the right thing only works -- in the long run -- if it pays for itself. So it's hard to have a whole bunch of silver that I paid $42/ounce for, now valued at $21. How does that help me? First, I believe that silver's price is woefully suppressed and that "some day" it will be worth much more than I paid for it. Secondly, I've taken away my assets from places that our bankrupt government has easy access to. Cash in the bank is easy to take or tax. Stock prices are easy to crash or inflate, or convert to government bonds if that is what the elites desire. The ruling class may create regulations meant to gum up the convertability of PMs to cash or other assets, but I will have the option to participate in a black market where precious metals transactions are not reported, if the citizen participants deem the rules to be grossly unfair and punitive. The larger question here is one of financial solvency as investors await PMs to gain value in US dollar terms. The plan should be to be patient, hold onto a good job if you can, reduce your debts, and wait for a beneficial time to convert your metals to a large purchase such as a home. With the metals I have, my hope is to be able to buy or build a nice home and still have some money for retirement left over.

The targets for this conversion relate to where the PM bull market is in terms of peak valuations. At is peak 15 ounces of silver ought to buy 1 ounce of gold (today it takes 62, so we have a long way to go); and two ounces of gold (or less) should buy the DOW (today it takes 13). So we're talking a 6-fold increase in gold prices, and a 24-fold increase in silver prices, relative to stocks. Right now silver is $21, gold $1300, and the DOW is at 17,000. The wait for a PM market peak could be a long one, with some major crises along the way to achieve the fear and rejection of the current system that is required. It will be at that point that I convert my PM holdings to real estate and equities. In the meantime: DON'T SELL!!!!

Be strong, be resourceful, and good luck!

2014.8.30. King World News Interview with Egon von Greyerz

Deflation in asset prices will destroy banks. Though there will be a drop in asset prices of all kinds, paper assets will go down the most. Interest payments on the gargantuan public and private debts will become impossible. Nations and individuals will go bankrupt. The financial system will fail. But then there will be extraordinary money printing. If there is a shift to a gold backed international reserve currency, gold will do better than silver. The central banks hold gold, but they are not holding silver. Silver will still be better than holding fiat currency that will be massively devalued. Before a new reserve currency is established there will be a run up in the price of precious metals, and silver will outperform gold, reaching a 20:1 ratio or better. But that won't be long lived, as gold will reassert itself. You should have mostly gold, and a smaller percentage of your PM allocation in silver. There should be no central banks. We should have markets that are determined by natural market forces and not CB manipulation and money printing that benefit just stock market and the bankers but not the real economy. Matterhorn Assets has precious metals storage vaults throughout the world, including under an airport in Switzerland and deep inside the Alps. There are many black swans or potential disruptions geopolitically and financially that you must be prepared. Just make a plan and stick to it, and live your life each day without excessive worry. Just do your best and don't fret over things you cannot change or effect. Don't invest in paper gold, as there is 100:1 leverage in this area and some day people will find that their gold is not there, just a paper claim on a physical asset.

From von Greyerz's home page, Gold Switzerland (pdf)

Matterhorn Asset Management/GoldSwitzerland is the only company in the world offering a precious metals investment service outside the banking system in four locations with direct ownership and private access for investors to their gold and silver.

Our Wealth Preservation Principles:

Gold/Silver must be stored outside the banking system.

Gold/Silver must be directly owned by the account holder.

Investors must have physical access to their Precious Metals.

Storage must be in a politically stable country.

Eliminate counterparty risk and accept No leverage.

Do not compromise on personal privacy and security.

Our Services:

Buy allocated Gold & Silver bars at Bullion Bank prices.

Sell Gold and Silver bars at Bullion Bank prices.

Safe storage of physical Gold and Silver in ultra secure vaults in Switzerland, Singapore and Hong Kong.

Ship and store Precious Metals that investors already own.

“I am more concerned about the return of my money, than the return on my money.” – Mark TWAIN

Gold is real money. Gold has been money for more than 5,000 years. No paper currency has survived throughout history. Gold has maintained its purchasing power whilst government deficits and money printing has consistently destroyed the value of paper money. With most sovereign states as well as the entire global banking system under severe financial stress, wealth preservation today is absolutely crucial. This is why physical gold should be an important part of any portfolio. For institutional investors this could involve allocating 5-15% of assets into physical gold as insurance and for private investors 25-50% should prove an excellent asset protection investment. GoldSwitzerland’s physical Gold & Silver hard asset investment programme is open to: Institutional Investors, Private Individuals, Hedge Funds, Family Offices, Companies, Trusts and Pension Funds.

2014.9.20. The Big Picture For Gold And Silver (pdf) * Death Of The Dollar - Hidden Secrets Of Money Ep 3- Mike Maloney

messymerry

Trust and confidence are the pillars of a successful monetary system, and trust and confidence are in the toilet.

hotrod

"Gold inevitably responds to an expanding fiat currency supply. That simple."

IN 1980 the US national debt was 1 trillion. Today it is 18 trillion. There are appx. 1000 billionaires today(not counting Jack Ma). None in 1980.

Gold reached an appx. high of 850 in 1980. Today it is 1200.

Has gold really kept up with expanding money supply???????????

The Dow has kept up. It is up 17-18 times where it was around 1980.

The reality is Gold has been very disappointing, and is not close to reflecting the huge monetary expansion. I am a gold advocate but the facts are the facts. It is very frustrating yet obvious where the Fed/bankers/Companys want the inflated money to go. Financial Assets. Jack Ma loves that Alibaba was bid to the sky. Gold restricts the money supply. I doubt the Stock Market would be 65 trillion had gold still been backing the dollar and other fiat currencys.

fockewulf190

Lets wait a bit and see what happens when the physical gold exchanges start really ramping up their operations. It is going to be very interesting to see who wins the price control battle for the gold and silver markets in the near future. If the price control shifts to Asia, as I suspect it will, the days of easy PM market manipulation achieved by the dumping of billions of dollars worth of paper gold and/or silver...regardless of price and often inside of mere minutes or less... will come to an abrupt end.

Paper gold and silver vs. physical gold and silver. It will be a short fight.

I see a shit load of kicking and screaming on the horizon.

bardot63

<<<<Has gold really kept up with expanding money supply???????????<<<

Has the Dow and S&P really kept up with the true economy? Or is the stock market keeping up with the lies and misinformation gov't feeds to CNBC and WSJ for the consumption of morons??? Gold is manipulated downward in price by criminal banks in collusion with the US Gov't, and the reason for the price suppression of gold is that the country is a helluva lot worse off than even ZH reports day after day. That suppression is coming to an end one day and when it does, it won't be pretty for anyone.

FlacoGee

Gold forces you to turn into a negative person. For gold to move you need war, currency collapse, financial collapse, strife, etc.

HamFistedIdiot

"Gold forces you to turn into a negative person. "

So I should invest in Pfizer instead? But doesn't all the Prozac we flush into the water supply make the fish hermaphroditic? Is feeling upbeat worth that price?

lasvegaspersona

For those of us who follow (and actually read) fofoa none of this is unexpected. Here is what he has said.. and his writing is based upon other writers and a long look at monetary history, game theory and some just plain logic and clear definitions:

Gold is the focal point of the monetary world. Gold and only gold gold has been selected as the focal point for wealth storage. It will emerge as such but first the paper gold market must fail. As long as large players accept the promise of paper gold, someone will deliver that paper promise and the price of gold will remain low. It could go very low as those who currently hold paper gold start to get out.

We see the ECB has kept a large store of gold on its balance sheet. Should/when the dollar fail that balance sheet will explode even as the US Treasuries go to zero. Gold alone will the 'back' the Euro...physical gold. When the dust settles gold, in physical form only, will find a much higher price/purchasing power. It must because gold at $1200 cannot act to back stop all the worlds currency and store most of the world's wealth. A price of over $50,000 in 2009 dollars purchasing power is ball park of what we expect. This jump would only be slightly more than the jump in gold price between 1971 and 1980. It rose 24 fold then....$35 to over $850.

Due to changes in the monetary system a drop is not expected as gold will not have emerged from a bull market but will have found it's correct role as a wealth asset.

After 400 articles and 6 years that's the best few paragraph summary I can give.

Gold.....get some...soon.

bardot63

You have the choice of being wrong now or being wrong later.

The mere printing of money is the definition of inflation. The result of inflation is higher prices. Credit creation is the same as saying debt creation. No economic system in the history of the world has survived that scenario. The current situation is not unique to history---it's been repeated many times, each time with disastrous results, without exception.

Printing money does not create wealth, it creates debt. Wealth is created by producing a product people want or need and will trade their wealth to have. Wealth is created by sweat and imagination and labor and time. Creating more and more money is not creating wealth. It's creating debt. You cannot become wealthy taking on more and more debt, and neither can any civilization grow and become wealthy by creating more and more debt. The US Fed did not create the debt of printed money. It only perfected it.

Creepy Lurker

@ FlacoGee, et al,

You are missing the point of holding PMs. They are not to make you rich, they are an insurance policy. Do you sink every penny you have into your homeowner's or car insurance? Of course not. Nor should you sink every cent you have into PM's. Just enough to let you sleep at night.

KCT comments

The Maloney video states that using credit cards and signing loans allow the banks to create additional debt out of thin air. I don't have a good understanding of credit creation and did not know this. All I thought was that there was some basic usury afoot with banks skimming 2% or more on every transaction for the simple action of transferring Federal Reserve Notes (FRNs), which are debt instruments from party to another. The banks should earn maybe .1% on transactions -- NOT 2% or more. Just enough to keep the lights on and pay an employee or two. In the meantime one should always pay with cash, or with gold when some kind of digital gold payment system is implemented.

The reference to FOFOA is a chastening one for me. This writer and many others state that gold will be the principle beneficiary in the coming asset-backed reserve currency. This past Friday, Sept. 18, 2014, the GSR hit 68 as the metals hit four year lows. It could very well be the case that gold will outperform silver dramatically if there is deflation and gold's value is reset. But what then of confiscation or exhorbitant taxation? If the aim is neofeudalism and depopulation, why would the elites allow the plebians to benefit from a skyrocketing gold price? If silver is "poor man's gold" and if the elites have amassed more power than ever in their financial market and political governanance manipulations, why should I expect any "poor man" silver owner to do well. Given that the elites own the debt printing presses, I imagine they would rather spend $1trillion to make the poor poorer than to let an additional $500billion of wealth be created that benefits the poor.

At present my savings are entirely in silver. Rule #1 in investing is diversification. But I guess I am a gambling man who has been swayed by the passionate entreaties of the silver bugs out there. I am hoping for a GSR of 30:1 or better to arrive, at which point I will trade my silver for gold. But will this ever happen? Is this 20 years off? The construction of my dream home hangs in the balance.

Regarding gold as fostering a negative orientation: For me it is not that way. It is simply a moral action of mine that is only minimally receptive to outside influences at this point. What I've learned about debt creation, the private Federal Reserve Bank, usury, fractional reserve lending, the Alinsky method of ballooning government expenditures and welfare payments to destroy the financial and moral character of a nation, and the ongoing $1trillion+ of federal budget deficit spending, leads me to have ZERO faith in the current political and financial structure. Silver is constitutional money; and gold and silver have been used as money and a store of wealth for 5000 years. The FRN is just 100 years old and hasn't much time left. I will have no more to do with it, even if silver's value now at $17/oz., when I bought much of mine at over $41, is the price I have paid for my moral convictions. Don't get me wrong. There is still a lot of greed in me. I am looking forward to a nominal valuation of 10x its current price. I just don't know when it will happen. I am hoping within the next 20 years, and that I stay afloat financially until then so I don't have to sell any at an inopportune time.

Commenters hotrod and fockewulf190 require rebuttal. The people that I listen to state that the DOW is overpriced due to Fed moneyprinting and all sorts of accounting shenanigans. If the DOW crashes and gold is revalued, the arguments for holding stocks as having been the better plan will be proven false. But it's all about timing, isn't it? I wouldn't have minded a 30% increase in my networth if I had jumped from precious metals to stocks a few years ago. But only the insiders know which way the wind blows. I stand on the side of nature (PMs), which is a constant; while stocks are the ephemeral creature of greedy men. As far as China or Russia or some other player changing the paper game, I won't hold my breath. Any sovereign nation could have used its unlimited supply of fiat currency to blow the COMEX price rigging game wide open by asking for physical delivery of the paper PMs they hold that are leveraged 100:1. That no one has called the elite's bluff demonstrates to me that the system itself is corrupt, or it's just different factions of elites with basically the same goals, and the time for a major PM revaluation has not yet arrived.

2015.9.6. Jim Sinclair-Silver Will Be Gold On Steroids In Coming Rally (Greg Hunter interview at YouTube)

Last night I watched this interview from 8/25/2015. For greedy, mistrustful precious metals buyers like myself, the past 4-5 years have been exasperating, with silver correcting 70% and gold down 40% while the US added $4trillion to its currency supply and with the federal budget deficit consistently at about $1trillion per year, with ZERO effort on the part of Washington, D.C. to curb the growth in government spending, free handouts to illegal aliens or the continued hemorrhaging of jobs to cheaper labor markets. All of this has occurred while the US stock market doubled in value due to 0% interest rate loans from the Federal Reserve given to corporations so that they can buy back stocks and goose prices higher even as revenues decline and no investment is made in research and development or the buildout of the business. I have been harangued weekly by family members who purchased gold at $1600 (now $1100) and silver at $33 (now $14).

Anyway, here are some of the points Sinclair made. The next rally in gold may be the one that smart traders "don't sell." That is, it will achieve a valuation that is permanent or stays within a narrow, but much higher range on account of the world's central banks needing the new price, presumably to back currencies or asssist in international trade settlement. Silver will perform even better than gold in the short term, but will be much more volatile, losing much of its gains before heading up again. The time frame for all this is unclear. Sinclair says that the recent DOW correction of 5% reveals the limitation of government intervention in the markets. He, along with many others, says that markets are more powerful than governments. Greater losses will be seen according to Sinclair and others by the end of 2015. Note that I've been seeing predictions like this for a long time, and they rarely turn out the way the soothsayers say.

At present there are about 150,000 views on YouTube, with many good comments. Predicting $50,000 gold is meaningless without knowing what the value or purchasing power of a $1 US fiat debt instrument is at that time. Will $50,000 buy a house or just a pack of gum? Anything is possible when considering various deflation/inflation scenarios. And then there is the question of confiscation of metals, taxation, and the move toward a purely cashless economic system. Under threat is any tangible store of wealth or productive capacity. Gold, land, diamonds, businesses. Physical confiscation of any of these assets could be ugly. While anything is possible, it is most likely that all sales (including the conversion of PMs to digital credits) will be tightly controlled. There will be a massive tax (30-90%). And the black market trade in PMs (ort anything outside a digital accounting) will be outlawed. Much of this will be justified as an anti-terrorism provision to "protect" us. Recent Hollywood-quality pro-gold videos by the CIA-created ISIS terror group in the Middle East (that happens to be toppling whatever government Washington, D.C. wants taken out -- leaving Israel alone and doing deals with US corporations, of course) demonstrates an attempt to condition the public to associate gold with terror.

I continue to be concerned with metals I have stored: at home, in safe deposit boxes at banks, at storage facilities, and at vaults outside the US. Every strategy has its pluses and minuses. The most important investment is your health. If you don't have physical and mental health, all the precious metals in the world won't secure a better life for you. You have to spend the money you need to obtain clean air and water, healthy food, and safe physical surroundings. There is an epidemic of dementia in the US that is due to aluminum and cellular radiation exposure. If I find a workaround for that threat, I'll let you know.

The poster DAVPK1 writes: "There is only one BIG problem with gold and silver. We are going to a fully digital credit system ( cashless). World government leaders are calling for it. It will give governments full control and it will end all attempts to circumvent their oversight. Don't want to pay for Obama care? Too bad they will just debit your account. Trying to hide excess cash? Not going to happen. If you don't get credit for it, it will be worthless. Gold and sliver will only be good if you allow yourself to be chipped and monitored and even then it might still be taken from you. It's time to face facts, there is no safe haven from the coming (not in 20 years but very soon ) cashless society. We are one war and one economic crash away from it."